Understanding Section 80C Benefits: ELSS vs Other Tax-Saving Options

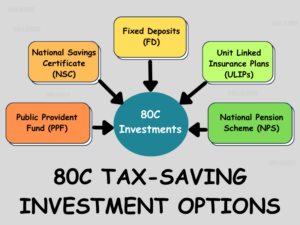

Tax-saving is a crucial aspect of financial planning, allowing individuals to maximize their savings while meeting long-term financial goals. Under Section 80C of the Income Tax Act, taxpayers in India can claim deductions of up to ₹1.5 lakh annually, making it one of the most popular provisions for tax savings. Among the many options available, […]

How to Use SIPs to Navigate Market Corrections and Rebounds

Market volatility can be intimidating for investors, but it also presents opportunities for wealth creation. Systematic Investment Plans (SIPs) are one of the most effective ways to navigate market corrections and rebounds. SIPs offer a disciplined and structured approach to investing, allowing you to benefit from market fluctuations rather than fear them. Here’s how you […]